Algorithmic Trading

Algorithmic trading empowers traders to automate strategies, back-test ideas, and scale their trading across multiple platforms. With programming, you can eliminate emotional decision-making, reduce errors, and diversify across hundreds of instruments simultaneously.

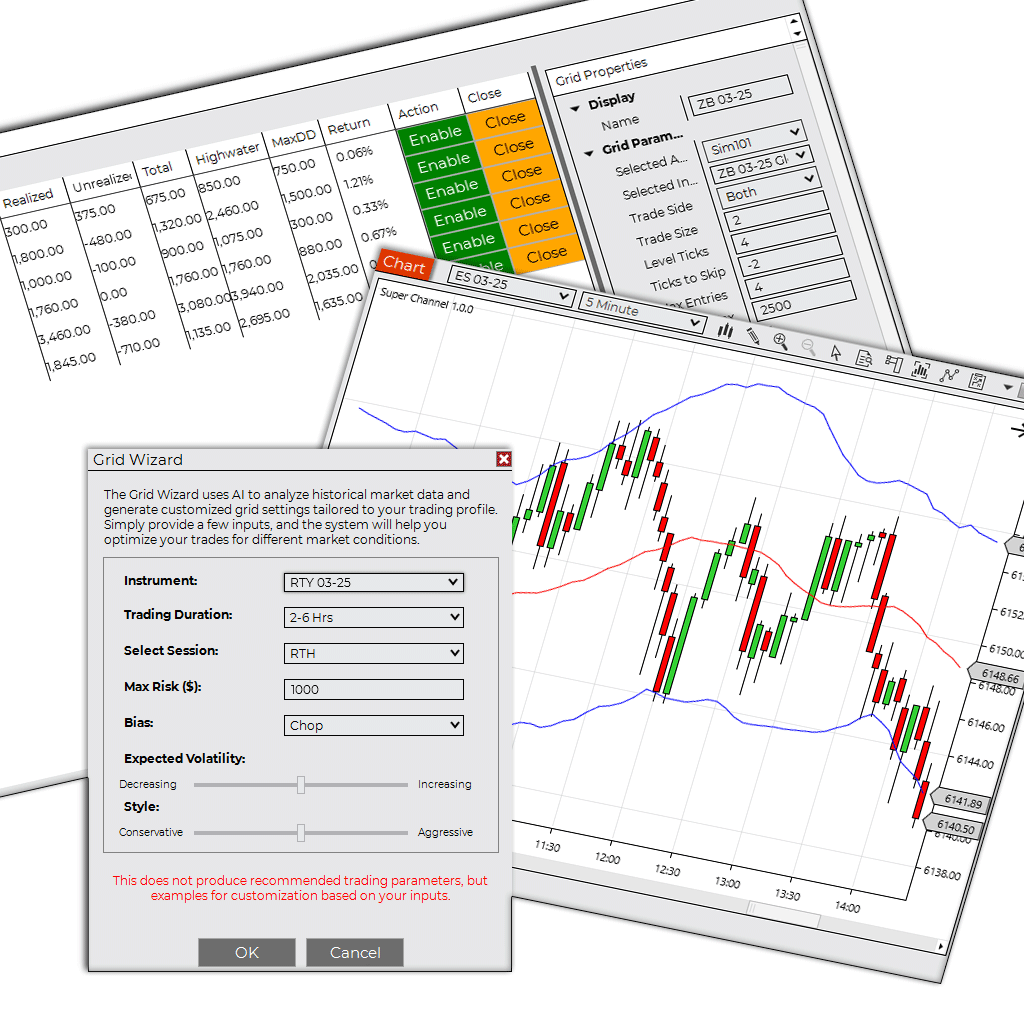

In this section, explore cornerstone content on platform programming — including NinjaTrader, TradeStation, MultiCharts, MetaTrader, TradingView, and the TWS API.

Start with our comprehensive cornerstone guide comparing all major trading platforms, then dive deeper into tutorials, case studies, and advanced development strategies tailored to your trading journey.