What is Technical Analysis?

Simply put, technical analysis is the process of analyzing current and historical price data for a given financial instrument. Usually, traders use a combination of charts and indicators to perform their analysis. When analyzing how the charts and indicators behave historically, traders are looking patterns that may help them predict future market movement.

What is a Technical Analysis Indicator?

A technical analysis indicator is a graphical representation of market activity over a given period of time. Typically, technical analysis indicators are statistics derived from price charts, which also represent market activity over a given time period. Usually, they are used to predict future price levels, or assist traders in identifying momentum, trends, volatility, and support and resistance levels (pivot points). Technical analysis indicators can be used to generate audio, visual, email, and SMS alerts when certain market conditions occur.

Types of Technical Analysis Indicators

Technical analysis indicators are generally classified as either Leading or Lagging.

- Leading Indicators - Leading indicators are designed precede price movements, which makes them predictive.

- Lagging Indicators - Lagging indicators are generally used as confirmation tools, because they tend to follow price movement.

While indicators are considered either leading or lagging, there are several additional categories that help define an indicator. An indicator can be classified as more than one of types mentioned below.

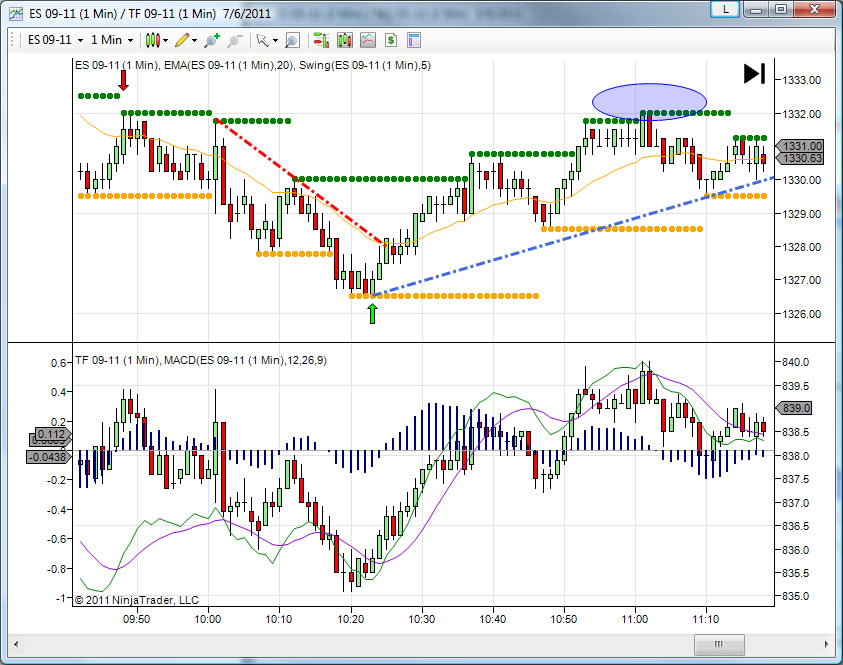

Oscillator Indicators

An Oscillator indicator is one that flucuates above and below a centerline (often the zero line or 50% line). Common examples of Oscillator indicators includes the Relative Strength Index (RSI), Stochastics, MACD, and Commodity Channel Index (CCI). The image above shows the RSI indicator. Looking at this image, a trader may conclude through their technical analysis that it is a good time to buy the market when the oscillator dips near the purple line. Conversely, it may be a good time to sell when the oscillator approaches the green line.

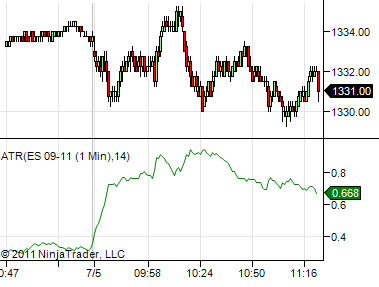

Volatility Indicators

Volatility indicators display the magnitude of price fluctuations over a specified time period. Commonly used Volatility indicators include the Average Directional Index (ADX), Average True Range (ATR), Standard Deviation, Bollinger Bands, and Keltner Channels. The image above shows the ATR indicator. Upon analysis, a trader may conclude that the market tends to make larger moves when the ATR indicator is giving a higher reading, and that the market will make smaller moves when the value is lower.

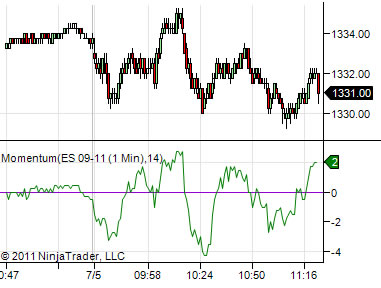

Momentum Indicators

Momentum Indicators display the speed at which price moves over a designated time period. Most momentum indicators are oscillators. When there is little movement in a given market, the oscillator will give a reading close to zero. If price is moving up rapidly, the indicator will produce a higher value, and when the price is moving down rapidly, it will produce a lower value. Common Momentum indicators include the Momentum Oscillator, RSI, MACD, Commodity Channel Index (CCI), Rate of Change (ROC) and more.

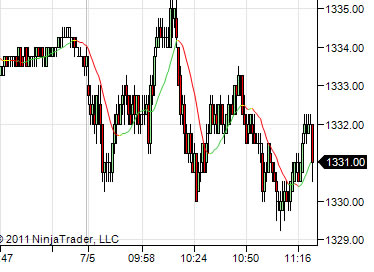

Trend Indicators

Trend Indicators provide a measure of the direction of the trend in a given market. Common examples of trend indicators include moving averages, Directional Movement (DM), Linear Regression, and Average Directional Index (ADX). In the image above the indicator changes from green when it is rising to red when it is falling. One may conclude through technical analysis that it is better to only buy when the indicator is green, or sell when the indicator is red.

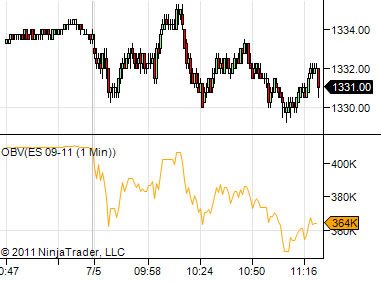

Volume Indicators

Volume is perhaps one of the most overlooked statistics. Volume Indicators analyze the buying or selling pressure for a market trend. Examples of volume indicators include Market Delta, Accumulation/Distribution (ADL), Money Flow Index (MFI), Volume Weighted Average Price (VWAP), Chaikin Money Flow, and Chaikin Oscillator. Volume indicators can be momentum indicators, trend indicators, and/or support and resistance indicators.

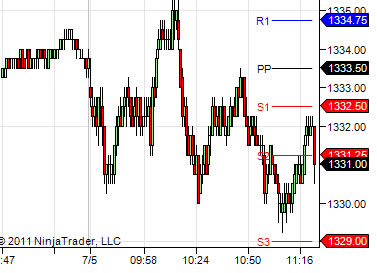

Support and Resistance Indicators

Support and Resistance indicators display key prices in a particular trading market. Support is a price level in which demand is thought to be high enough to prevent the price from declining further, while Resistance is a price level in which supply is thought to be high enough to prevent price from increasing further. The most common examples of Support and Resistance indicators are Floor Trader Pivots, Swing Highs and Lows, Fibonacci retracements and extensions, and more.

Need a Programmer to Create Your Custom Technical Indicator?

I provide fixed pricing for all projects, so there will be no surprises. Receiving a free quote for your project is simple. First, fill out the "Get Started Now" form below with as much detail as possible about the custom technical indicator you need. Also, make sure to attach any supporting images, documentation, videos, or code that may be needed. I am usually able to respond within 1 business day with either a quote or some additional questions. Once I have all of the necessary information, I will provide you with a fixed price for your programming project(s). At that point, you may decide if you would like to proceed or not.

Get Started Now

Trading is a very competitive business and I fully understand your concerns about your trading ideas falling in to the wrong hands. Any information that you send will remain 100% confidential, and you will maintain full rights to any programs I write for you. I am also happy to sign a Non-Disclosure agreement if that makes you more comfortable.

You can rest assured that your private information is fully protected and not revealed to anyone.

Leave A Comment