Automated Trading Basics

Automated and algorithmic trading open the door to faster decision-making, greater diversification, and reduced human error. Instead of manually scanning hundreds of securities, algorithms can evaluate opportunities, back-test ideas, and execute trades across multiple markets in real time.

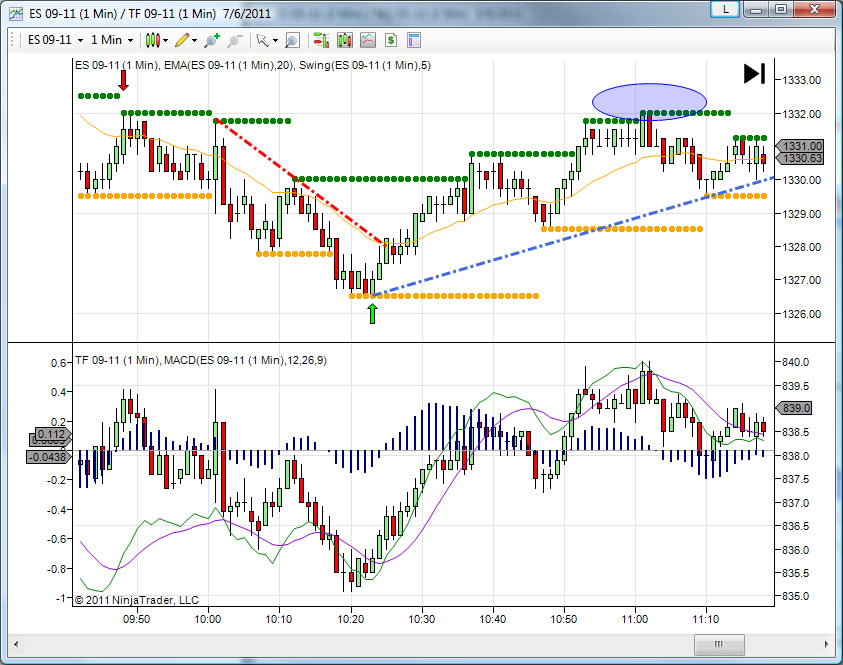

To help traders get started, I’ve built a collection of professional NinjaTrader tools that demonstrate the power of automation:

- Time-Limited NinjaTrader Renko Bars – enhance your charting with flexible, time-sensitive Renko bar construction.

- Grid Master Add-On – a powerful grid trading system that automates entries and exits.

- Divergence Indicator – spot hidden opportunities by tracking divergence between price and momentum.

- Delta Bars – gain deeper market insight with order flow and volume delta analysis.

Whether you’re exploring the basics of algorithmic trading or ready to

implement advanced tools, this section will guide you through the essentials and connect you with resources to accelerate your success.